The 10 Metrics for SaaS Startups (an Early Stage Operator's Guide)

Focusing on the wrong things can kill your startup.

Based on founding and scaling @edenworkplace, here are the metrics that matter most:

Metric 1: ARR (Annualized Recurring Revenue) - You will need to know this number each day, so you'll focus on Contracted ARR in your CRM tool (as opposed to accounting ARR). Big ARR milestones are $100K (Signal), $1 million (PMF), $10 million (Growth), $100 million (IPO Scale)

Metric 2: ARR Growth - Once you get past the Signal stage, your ARR growth is the primary determinant of future success (and valuation). Strong annual growth rate from Signal to PMF is 4x+ and from PMF to Growth is 2.5x+. @edenofficemagic grew 11x between Signal and PMF stages.

Metric 3: ACV (Average Customer Value) - ACV often starts low for a SaaS company (as your product is not featureful enough for large enterprises) and grows as the company moves upmarket. ACV is calculated by taking total revenue and dividing it by your number of customer logos.

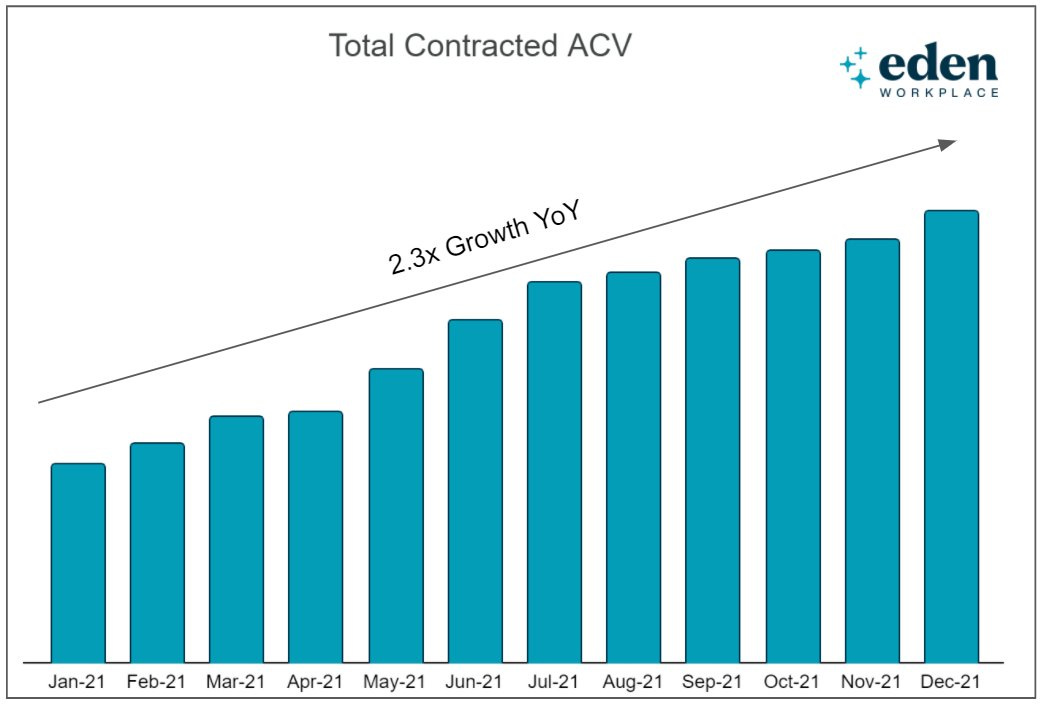

Metric 4: ACV Growth - Most SaaS companies will make ACV growth a focus. It is fair to increase revenue per customer as you add more value to users in new features, integrations, and products. @edenofficemagic grew ACV 2.3x last year, mostly through cross-selling new products.

Metric 5: NDR (Net Dollar Retention) - NDR tracks what happens to $1.00 of avg customer revenue 12 months after acquiring the customer. You want positive NDR, as that means customer expansion more than offsets reduction and churn. Below are @edenworkplace's cohorts (132% NDR).

Metric 6: Gross Revenue Churn Rate - A high churn rate always catches up to you, typically in the Growth stage. "Good" depends on ACV here. Very SMB can be > 30% annual gross churn. Enterprise is typically < 10%.

Metric 7: Gross Margin - Generally, a good SaaS company is well north of 60%, and ideally closer to 80%. Be conservative: include CSM and support costs in COGS, not just product costs such as AWS. Your VCs will be conservative, so you are better off not deluding yourselves.

Metric 8: CAC Payback Months (on Gross Profit) - CAC is calculated by taking sales and marketing cost and dividing it by the number of new logos acquired. Then divide CAC by avg gross profit contribution of new logos to determine payback. 6-18 months payback is often the goal.

Metric 9: Months Cash Runway – Cash is like oxygen. When you have it, you don't think about it. When you don't, it is all you think about. You calculate runway by taking cash balance and dividing it by monthly burn. Typically, startups aim for 24+ months at raise and 6+ always.

Metric 10: Pipeline – Pipeline is calculated as the sum of outstanding sales contracts (not closed won or lost). To some extent, your pipeline is your destiny. If you have enough, you will hit your goals. If you don't, you'll miss them. Watch it closely.

These are the 10 metrics that matter most for running a SaaS company. If you keep an eye on them, you'll at least know when you need to course correct.

Onwards + upwards,

Joe